SMM, January 5:

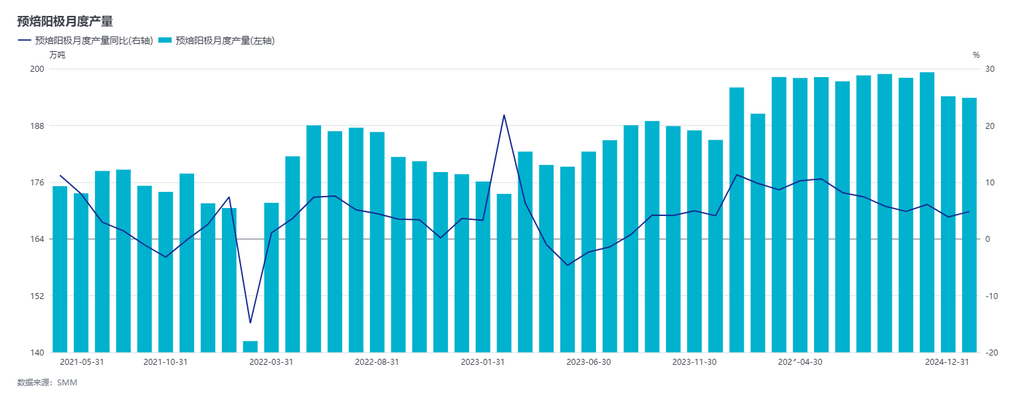

According to SMM survey estimates, China's prebaked anode production in December 2024 was 1.9382 million mt, up 4.81% YoY and down 0.17% MoM. Among this, supporting prebaked anode production was 866,500 mt, and commercial prebaked anode production was 1.0717 million mt. The cumulative prebaked anode production in China for 2024 reached 23.6092 million mt, up 7.56% YoY.

In December 2024, the operating conditions of domestic prebaked anode enterprises slightly declined. In some areas of Henan, Hebei, and Shandong, production was slightly reduced due to emergency controls for heavy pollution weather, with both calcination and baking processes affected to varying degrees. Additionally, some enterprises resumed operations after maintenance. SMM estimates that the industry's operating rate in December was 77.44%, down 0.13 percentage points MoM.

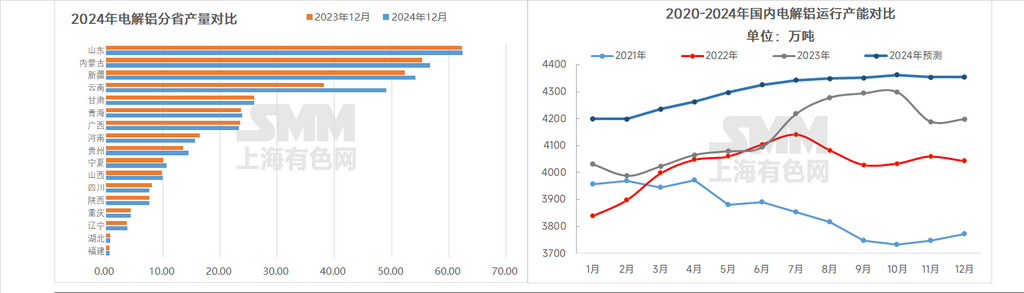

Domestic demand: By the end of December, SMM statistics showed that China's aluminum existing capacity was approximately 45.71 million mt, with operating capacity around 43.53 million mt. The industry's operating rate increased by 2.49 percentage points YoY to 95.38%. Currently, the operating capacity of domestic aluminum smelters shows both increases and decreases. The increases mainly came from the ramp-up of a new project at an aluminum smelter in Xinjiang, while the decreases were primarily due to production cuts at multiple aluminum smelters in Sichuan caused by losses and at a specific smelter in Guangxi due to technological transformation. Additionally, a capacity replacement project at an aluminum smelter in Inner Mongolia is proceeding as planned and is expected to be completed within the year, while a quota replacement project in Ningxia has been completed. Entering January 2025, domestic aluminum operating capacity remains stable. The negative impact of earlier production cuts on output has become evident. SMM has learned that no additional enterprises currently plan to cut production. By the end of December, the annualized operating capacity of domestic aluminum smelters remained steady at 43.53 million mt/year.

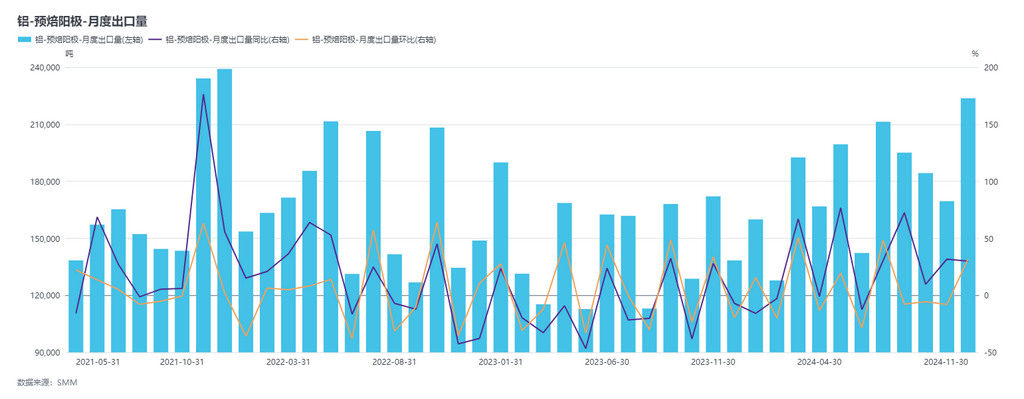

Overseas demand: China's prebaked anode exports in 2024 saw significant growth, with November's export volume hitting a yearly high. With the favorable performance of the domestic raw material market, export prices in December also increased. According to SMM estimates, the total export volume of prebaked anodes in 2024 is expected to exceed 2 million mt, significantly higher than the export level in 2023.

Brief analysis: In December, due to environmental protection-related controls, prebaked anode production in several regions experienced a slight decline. However, with the gradual release of capacity from new projects in north-west China and the resumption of production after maintenance by some enterprises, the overall supply reduction was relatively small. On the demand side, the operating capacity of domestic aluminum smelters shows both increases and decreases, with overall production slightly rising. It is expected that in January, aluminum enterprises will maintain stable operating capacity, and prebaked anode demand will remain relatively stable. Meanwhile, the unexpected price increase of prebaked anodes in January 2025 has improved the industry's profitability. Additionally, some aluminum enterprises are currently signing prebaked anode procurement contracts for 2025, indicating active demand. In summary, SMM expects prebaked anode enterprises to maintain high operating rates to meet market demand.